Customs Brokerage Services Streamline Global Trade Exports

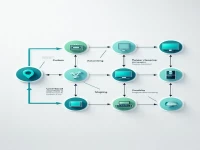

Tired of complicated customs clearance and inspection procedures? We offer one-stop import and export services, from commodity classification to document preparation, advance payment of tariffs to handling various certificates, helping your goods clear customs easily and reach the world. Our professional team, efficient service, and transparent pricing allow you to focus on your core business and achieve greater commercial value. Let us handle the complexities of international trade so you can focus on growth.